Get all our templates, tips, and fresh content so you can run effective, profitable, low-stress projects in your agency or team.

As your business grows, you will inevitably reach a wider, more diverse range of clients. Each of these clients will have different ways of interacting with your business, both in generating revenue and incurring costs. Not all customers, however, are equal—some are more profitable while others are less so. This is customer profitability, which we will explore below, along with steps for analyzing and acting on this information.

What is Customer Profitability?

Customer profitability is a measure of the financial value that a customer, or customer segments, brings to your business.

What drives customer profitability? This can look very different for each client, but the main factors involve revenue generated by the client, against the total of direct and indirect costs on the business to serve them. This includes the cost of materials, operations, and even taxes.

While the immediate insight provided by client profitability is financial value, this creates room to understand the relationship between your business and the customer, and how their habits and preferences are affected by your marketing and sales strategy.

Let’s illustrate a simple client profitability example: say you have two customers A and B, who both make bulk orders for plain white shirts to print designs on. A is a larger business, so they order considerably more stock than B. At first glance, you might think that A is a more profitable customer—however, this doesn’t factor in that A’s business is located much further away from your warehouse than B, which means they incur higher costs for delivery. The numbers would then tell a different story.

While Customer A’s revenue is higher on a per-order basis, that business doesn’t come cheap compared to what it takes to serve Customer B. Following this high-level pattern, Customer B turns out to be the more profitable arrangement.

Why is Customer Profitability Important?

Of course, our above example is a highly simplified view of the concept, and there are many more factors at play depending on the nature and scale of your business, especially when it comes to cost. Customer profitability exists to quantify these factors and allow you to make informed decisions about your marketing and sales strategy.

This translates into a more positive cost-benefit ratio—by determining which clients are most profitable, you can shift your strategy to either invest more in high-value customers or generate more savings when serving relatively lower-value clients. Doing both allows you to compound potential gains while providing optimal services.

Not only does client profitability highlight valuable customers, it also helps to highlight which parts of your strategy contribute most to those results. This can be a matching sales channel, an ideal set of resource allocations, or an excellent customer service arrangement. Customer profitability helps illustrate the relationship between your business and your customers.

This is where customer profitability analysis comes into play.

What is Customer Profitability Analysis?

- Accounting tool for analyzing activities and expenses related to servicing a particular customer; profit per customer vs profit per product

- Simple Formulas

- Customer Lifetime Value (CLV) - all-time revenue (though misses out on retention factors, and costs beyond acquisition)

- Average Revenue per User (ARPU) - total revenue / total subscribers

A customer profitability analysis is an accounting and reporting tool that measures activity and expense related to serving a customer against their generated revenue. The specific activities, expenses, and revenue-generating engagements are different for every business, but for starters, here are some simple formulas for computing revenue, which is your initial building block for measuring client profitability:

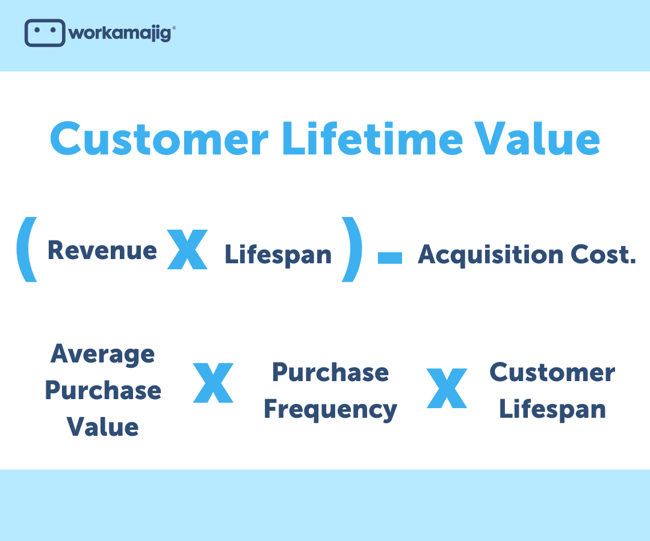

Customer Lifetime Value

Customer Lifetime Value (known as CLV, CLTV, or just LTV) is a projection of the total potential value a customer generates for your business in the lifespan of your relationship. This is typically computed using the following:

- Revenue or Average Purchase Value - where revenue can be the total amount you’ve collected from a customer while average purchase value is the average cost of one transaction.

- Purchase Frequency - used in tandem with average purchase value, for computing profitability within a specific time period.

- Lifespan - the total time spent being in business with the client. This can be based on the specific client’s presence, or an industry benchmark.

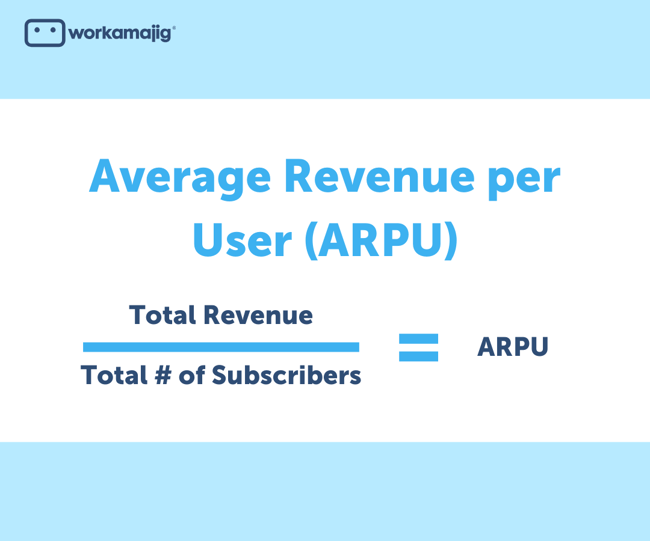

Average Revenue per User (ARPU)

Average Revenue per User is a useful metric for subscription or membership-based services. The formula is rather straightforward: take your total revenue, and divide it by the number of users or subscribers.

The ARPU is used in tandem with customer profitability analyses by highlighting trends in customer behavior. An upward trend means that one or multiple parts of your strategy for that customer segment are working; comparing your profitability analysis with that of another customer segment can then help you identify which touchpoints might be causing this upward trend.

How to Calculate Customer Profitability

Now that we understand the concept and importance of customer profitability, here are the steps you should take to build a comprehensive customer profitability report:

1. Collect revenue information from all relevant sources

First, figure out the total revenue generated by all of your customers. Depending on your report, this could be within a given period, such as a month, quarter, or year. It’s also important to note where this income is generated, whether that’s from direct sales, support services, subscriptions, or other income-generating options you have available.

2. Identify customer segments and their value

Next, look at all of your clients and observe for patterns—this will help you create customer segments, which are groups of customers based on similar characteristics. These segments vary greatly between businesses, so consider whether factors like location, nationality, volume of orders, or purchase frequency are relevant to your analysis. Various tools are also available that can help you identify these customer segments.

Another way you can identify customer segments is through buyer personas, which are profiles that illustrate your customer’s behavior, preferences, and obstacles, and might already be available from the start of your marketing campaign, as this is a key part of building strategy.

From there, segregate your revenue information across your resulting customer segments.

3. Determine touch points and costs

With each customer segment, it’s not time to list down the different ways you interact with them. This can be anything from customer service, social media, packaging, and delivery, among others. From there, compute how much it costs to enable each of these channels to serve your customers. It’s also important to account for indirect costs, such as taxes, administrative and licensing fees.

4. Compute for profitability

With each customer segment and their associated revenue and costs identified, it’s time to put them together. Following the basic formula:

Profit = Revenue - Costs

Do this for every customer segment you’ve identified.

5. Analyze results

Now that you have a unified profitability score for each customer segment, it’s time to identify which of them generate the most value for your business and which ones are not as lucrative. Look for patterns in the activities and the sales associated with each customer segment—are there activities that commonly occur where higher profits are generated? Are lower-value clients exposed to touch points that end up costing you more than doing business with more profitable ones?

Using the steps above, you can generate all kinds of profitability analyses, which you can use to update your business strategy accordingly.

Improving Customer Profitability

After creating your client profitability analysis, it may be tempting to easily ignore low-value clients in favor of a higher number. However, an important part of your strategy is to ensure that you’re not alienating existing customer segments, maybe even attracting new types of customers using your updated approach. In many cases, it’s also much more cost-effective to retain and improve on existing customer relationships than to build new ones.

One of the ways you can do this is to offer adjusted tiers of products and services that make it more attractive for your low-profit clients to increase their business. This can also come with various upgrades or freebies, compared to a one-size-fits-all approach. For customers who incur high costs despite low purchase rates, consider looking into ways of reducing operational costs.

For high-profitability clients, consider investing in exclusive promotions, VIP, and preferential services, such as priority customer services or faster delivery options. You might also expose them to other products or services that you offer, that might be things they get elsewhere; this is attractive because they save on resources interacting with multiple providers, whereas they can get a better deal doing all of that business with you.

In most cases, you benefit more from improving your products and services for all customer segments, as goodwill and brand reputation are critical bonuses to your marketing reach. As your business scales, adding new offers that augment existing relationships, while potentially attracting new clients, will help your business stand out as a reliable resource.

Build Customer-Centered Strategies with Workamajig

A customer profitability analysis plays a critical role in making sure your business keeps up with market demand. By highlighting cost-effective relationships and activities, you can make strategic changes to maximize these benefits while maintaining trust between you and your customer base. To facilitate these changes, you will need an agency management solution that can keep up.

With Workamajig, the premier agency management software, you have an all-in-one solution for planning, organizing, and delegating these efforts, and easily transitioning between the phases of every project. Easily adjust your schedule or modify task requirements and assignees to ensure efficiency, and use native reporting tools to measure your progress, as well as identify and address roadblocks along the way.

Related Posts