Get all our templates, tips, and fresh content so you can run effective, profitable, low-stress projects in your agency or team.

This post was originally published on January 23, 2014 and was updated with new information on February 20, 2020.

What's the best way to bill your clients? Fixed cost by Project? Time and Materials? How can project management software help in your billing process?

In a business where you must bill your clients for services, choosing the right method of billing is absolutely essential. It may take time to determine whether you should bill your clients a fixed amount by project or bill based on time and material costs.

In some instances the choice is clear. However, in other situations, it can take greater consideration to select the right method for billing.

There are a few basic considerations that you are going to want to make when choosing a pricing model for your clients.

In this article, I’ll walk you through a detailed process for choosing the right billing methods and using project management software to help with billing.

How Billing Processes Affect Client Retention

The billing process is heavily underappreciated in the creative industry. It is usually seen as a basic, utilitarian procedure of identifying what should be charged and to whom. But when done wrong (or right), it can have a measurable impact on your client retention rates.

To help understand the importance of your billing process, consider the following ways it impacts client retention:

1. Provide Details in Invoices

If you're attracting the right kind of clients, they'll seldom nickel and dime you when it comes time to pay invoices.

But what no client likes is a surprise. They're usually happy to pay your rates, but they want to know exactly what you're paying for.

In the absence of a project management software-linked billing process, you have to pull together all the work data manually. How many hours each resource worked on, what extras did you charge them for, what you paid vendors for additional materials - Clients want all these details.

If your billing process doesn't include them, your clients will eventually start complaining.

2. Streamline the Billing Process

Have you ever sent in an invoice three weeks late simply because you couldn't find the time to put all the details together?

Clients dislike this in particular. Most have set periods when they pay their vendors. An invoice coming in three weeks late messes with their finances and cash flow.

Unfortunately, if you don't have PM software-linked invoicing, putting together all work details will naturally take time. Similarly, if your billing process still requires manually creating physical invoices or asking for payments via physical means, you will annoy clients and hurt your own cash flow.

3. Customize Client Invoices

The client's logo on the invoice isn't going to make or break the relationship, but it is a nice touch.

What matters more is that your invoices include whatever particular custom details the client wants. Maybe they want a detailed breakdown of all resources used. Or maybe they want to know exactly what vendors you used for the project.

In either case, not including such custom details can be a red mark against you in the relationship. If your billing process doesn't support such customizations, you can move just a little bit closer to losing the client.

How to Evaluate Different Billing Processes

As an agency, you are essentially trading your time for money. Some creative agencies have their own products, but by and large, delivering services is how you'll make the bulk of your revenue.

When you're trading your time for money, a number of billing tactics become available to you. You can ask clients for a monthly retainer, get them to pay for time and material cost, or do project-based billing.

Here's what you should consider when evaluating different billing tactics.

1. Industry Norms

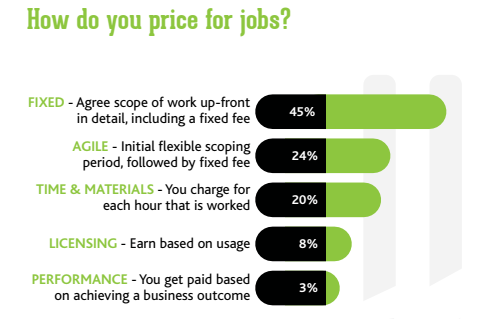

Every industry has some established billing protocols. In a survey of independent agencies, 45% of respondents said that they billed on a fixed fee with details worked up-front. 20% said that they billed on time and materials, and only 3% said that they billed on performance.

This is for independent agencies. Things might be different depending on your industry and business size.

Following industry norms - fixed fee, time & materials, etc. - is usually a good billing practice since:

- Clients are comfortable with it

- Most billing issues have already been worked out by your peers.

- You have access to project management and billing tools to make billing easier

The downside to following industry norms is that it doesn't take into account your workflow or financial concerns.

2. Fixed and Variable Costs of Your Business

For every agency, all costs can be broadly divided into two categories:

Fixed Costs

These are expenses you would incur even if you did not do any work in a particular month, i.e. costs you HAVE to bear to keep your business up and running.

Office rental, utilities, maintenance costs for office equipment, legal costs, etc. are all fixed costs. Think of this as the minimum amount you have to spend to keep your business afloat. This usually doesn't include any salaries (including your own).

Variable Costs

The IRS defines variable costs as any expenses incurred to complete a project. Staff salaries, project-specific software cost, contractor salaries, cost of materials, etc. are included in variable costs.

Besides these, there are plenty of other hidden variable costs as well. For instance, if you take out a loan to buy a tool, the interest on the loan is considered variable cost. Temporary space or equipment you have to rent for a project (such as a studio space for a photo shoot) are also categorized as variable cost.

Your billing rates will depend on your variable costs (clients aren't expected to bear your fixed expenses). Therefore, keeping a close tab on fixed and variable costs is crucial for picking the right billing method and rate.

3. Number of Projects Per Year

Some billing methods have a higher administrative burden than others. Choose the wrong billing method and you might find yourself overburdened by administrative tasks.

For example, a flat-fee pricing model with tail-tip billing (50% upfront, 50% on completion) has minimal administrative requirements. You don't need to track hours and expenses; you only need to charge once before the project starts, and once after it is delivered.

A time and materials billing model, however, requires close time tracking. You also need to have established hourly rates for each resource. In case you have outside contractors working on the project, you have to track their time and rates as well.

All of this makes time and materials an administratively complex billing model, especially if you have a large number of ongoing projects.

Keep this in mind when picking a billing method.

4. Complexity of the Project(s)

Does the client keep changing the project scope every few weeks? Does the project have a large number of deliverables? Do you need dozens of people working on the project at the same time?

Generally speaking, the more complex the project, the more nuanced you'll have to be with billing. Frequent scope changes can quickly make flat-fee billing unsustainable. Tracking a large number of people at different hourly rates, on the other hand, can be administratively complex.

Pick a billing method that aligns with the complexity of the project. A simplified billing method such as flat-fee billing might sound attractive initially, but as the project becomes more complex, it will eat into your profitability.

5. Client Preferences

While all the above four points are focused on your agency, do consider what your clients prefer as well. Some clients will have very clear preferences for how they want to pay. Others might not be quite as upfront.

Nevertheless, ask your clients what they're comfortable with and use that to inform your choice.

In some cases, a large client might ask for specialized billing for itself. Coca-Cola, for instance, changed how it paid ad agencies in 2009 by giving them the option to earn more if they met certain performance metrics, aka 'value-based' agency compensation model.

Each of these components should play a role in determining what method you use to bill your clients as well as how much you will bill your clients for the work that you complete.

Pros and Cons of Different Billing Processes

Retainers, fixed cost by project, time and materials cost - there are a number of ways to bill clients. In this section, I’ll consider the pros and cons of common billing methods.

Fixed Cost by Project

Also called ‘fixed-fee’ or ‘project-based’ pricing, in this method, you charge a flat fee for each project. It doesn’t matter how many (or how few) people work on the project; you get paid the same as long as you can deliver it to your satisfaction.

Fixed-fee pricing requires extensive upfront calculations to understand the expenses involved in delivering different project types. Once you understand the expenses, you can add a profit margin into the price.

Fixed-fee pricing is popular among small agencies who want to reduce client resistance and don’t want to deal with the administrative burden of hourly billing.

Pros

- Simplicity: The greatest benefit of this method of billing is its simplicity. A client requests a project and you can immediately turn around with a price based on the specifications. This keeps things simple for you as well as the client.

- Predictability: With project-based billing, you know exactly how much you’ll receive for the project.

Cons

- Lots of upfront work: To determine the fixed cost of the projects, you must first conduct a lot of calculations to determine which price is right for each type of project. If you are not careful, it is possible to severely overcharge or undercharge, severely shorting either yourself or your client in the process.

- Scope changes: If the client requests lots of scope changes, the project can easily become unprofitable. You will have to have strict policies for how you use your time to prevent scope creep.

- Higher risk: With project-based billing, the agency takes on all the risk of completing the project on time and within the stated price. If the project takes longer or incurs higher expenses, the agency will have to bear the burden.

Time and Material Costs (Hourly Billing)

Time and material costs or hourly billing is the original, and still the most popular billing method. The idea is simple: you bill clients based on the number of hours worked and any additional cost of materials. The profit is built into the hourly rate.

You might have blended or tiered hourly rates:

- Blended rate is when you have a single rate for all resources, usually an average of their individual hour rates.

- Tiered rate is when you have different rates for each resource (‘designer’, ‘junior front-end developer’, ‘senior front-end developer’, etc.).

Despite its popularity, hourly pricing is quickly losing favor with both agencies and clients in favor of more transparent pricing models.

Pros

- Precision: The greatest benefit to this method of billing is that you can be precise in billing exactly what is due for the project by billing specifically for time, materials and other costs.

- Profitability: Since the hourly rate already includes your profit margin built-in, you can be 100% of profitability, regardless of the number of hours worked.

Cons

- Hard to estimate: You cannot immediately provide clients with an exact cost and an initial estimate may not be close.

- Does not encourage efficiency: Since you are going to be paid for each hour worked, there is no incentive to be efficient. In fact, being more efficient even costs you additional revenue.

Billing based on time and materials can be ideal in service-related projects where cost really does come down to billable hours and the specific costs for materials such as replacement parts.

This method of billing is not always the ideal solution, however, such as in projects where different levels of expertise go into the billed time.

Retainer-Based Billing

In retailer-based billing, you charge the client a monthly, quarterly or annual fee to manage their monthly creative/marketing work.

This billing method depends on you estimating the amount of effort required to complete the monthly work and charging a fee accordingly.

For example, if you charge $100/hour and realize that the client’s monthly work takes 100 hours/month, you can charge a retainer of $10,000/month.

Retainers are usually fixed; you get paid even if the work is less/more than your initial calculations.

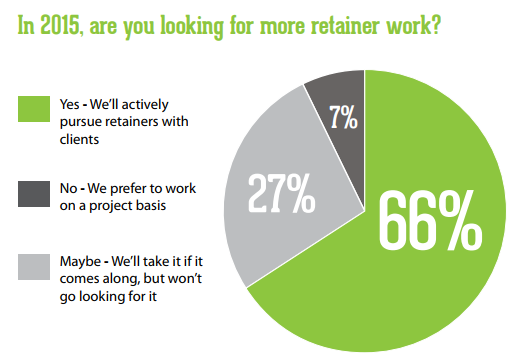

Retainer-based billing is particularly desired among agencies since it creates predictable revenue. In one survey, 66% of UK-based independent agencies said that they were actively looking for retainer work.

Pros

- Predictable revenue: A monthly retainer is definite revenue. It doesn’t matter whether how many (or how few) hours you work; you will get paid each month based on the retainer value. This eases a major problem for agencies - cash flow.

Cons

- Have to manage expectations: You have to actively manage your client’s expectations lest scope changes eat into your profit margins. If a client is paying $10,000/month, you need to be clear what you can deliver in that budget.

Agencies often pair retainer pricing with an hourly billing, aka a ‘hybrid’ model. This gives them predictable monthly revenue while also giving them the room to accommodate scope changes without affecting profitability.

How to Choose the Right BIlling Method?

Choosing the right method of billing is ultimately going to come down to the business you are in, the types of projects that you offer and what method of billing will best benefit your needs.

For some professionals, what this may entail is alternating between fixed cost billing and billing for time and materials depending on the individual project and client.

Unfortunately, this can further complicate things because you have to juggle both types of projects and both methods of billing depending on what is on your plate. Often the best solution in this situation is to rely on project management software to simplify the process.

How Project Management Software Can Help

Project management software is designed to simplify the management of projects in a variety of settings and industries. It can also serve to streamline the billing process by keeping track of the many different types and ways of billing, allowing you to more easily bill clients regardless of their project specifications.

Project management applications can simplify the tracking of materials costs and time spent on a project to determine how much current charges are, allowing you to choose which method of billing is ideal from project to project without relying on one or the other.

This makes billing significantly easier and reduces the administrative burden associated with complex billing tactics.

Conclusion

There are a number of ways to bill your clients - retainer-based, hourly billing, fixed-cost billing, etc. Each of these methods has its own pros and cons. Some, such as fixed-cost billing, are simple and transparent but offer limited flexibility. Others, such as time-based billing, give you great flexibility but can be hard to manage.

What billing strategy you adopt will depend on the size of your business, the complexity of the project, industry norms, and client preferences.

You can also try using a project management software to reduce the administrative burden associated with billing clients.