Get all our templates, tips, and fresh content so you can run effective, profitable, low-stress projects in your agency or team.

The agency business is a tough one. There are over thousands of agencies in the US alone fighting for the same clients.

In the face of such immense competition, you need some radical ideas to stir your agency’s growth. Conventional marketing tactics might work, but they are too slow for the fast-paced agency business.

The solution is to use unconventional agency marketing hacks to spur growth. These hacks range from using Twitter event targeting to “seeding” content with influencer outreach.

We’ll share some of our best agency marketing hacks below:

1. Use Twitter Event Targeting to Target Conference Participants

Event targeting on Twitter allows you to target people based on their interest in a specific event. This “event” can be as broad as “Back to School” or as narrow as a particular conference.

To use this tactic:

- Find a popular conference or event frequented by people in your industry (like SXSW)

- Use event targeting to promote content to people interested in this event

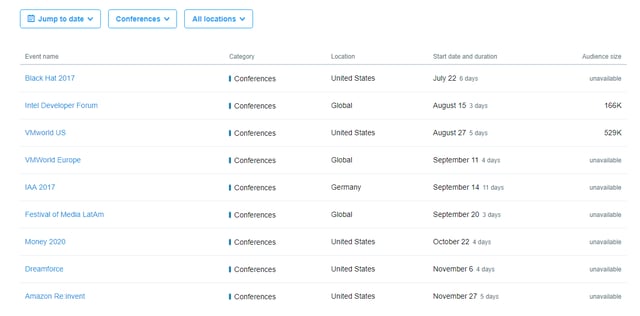

You can see Twitter’s roster of events by going to analytics.twitter.com, then clicking on “Events”. For best results, choose “Conferences” under ‘Event Type’.

Here are some conferences in the upcoming months:

For instance, if you serve software businesses in the sales/marketing sector, you can target Dreamforce attendees. Since these people have already shown interest in participating in the event (online or offline), they will likely want to consume content related to the event.

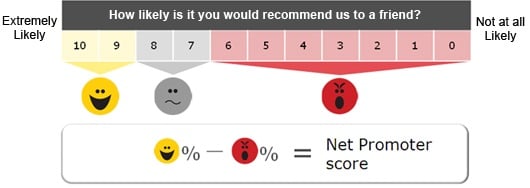

2. Set up an NPS Based Referral System for Clients

According to one HubSpot survey, referrals rank as the top source for new agency custumers

Despite their effectiveness, referrals are criminally underused as a lead source. 82% of business leaders start their purchase process with a referral, yet only 30% of companies have a referral program in place. One reason why agencies hesitate to ask for referrals is that they fear being too pushy. To work around this problem, use NPS (Net Promoter Score).

This is a three-step process:

- Calculate your NPS by asking clients

- Filter out clients who give you a 9-10 score.

- Ask these clients for referrals.

This ensures that you only ask your best clients for referrals.

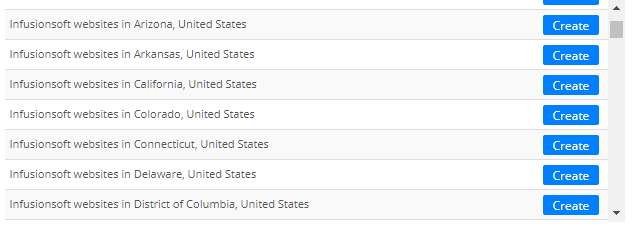

3. Use BuiltWith to Find Leads

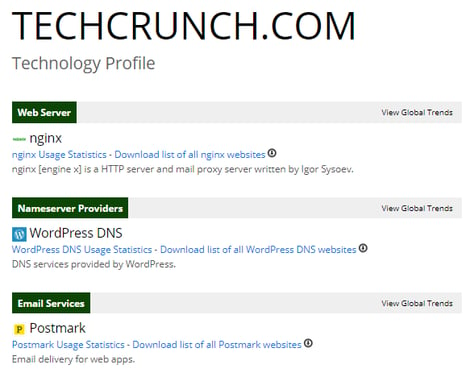

BuiltWith is a website for tracking a website’s tech stack. Pop in a URL into its search box and you’ll get a list of every technology or tool it uses.

Here’s the tech stack for TechCrunch:

If you specialize in a specific technology or tool, BuiltWith can be a fantastic source of leads.

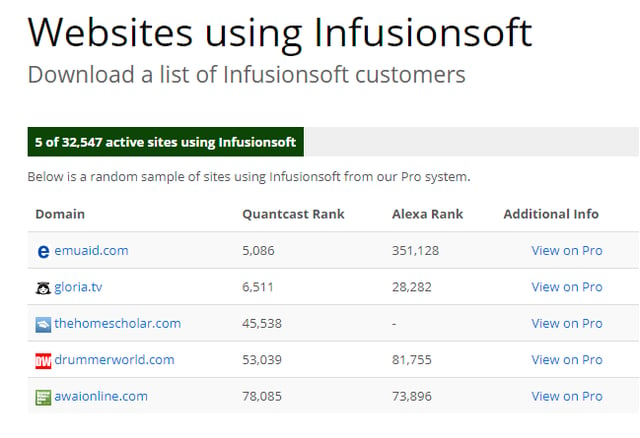

For example, if you focus on designing landing pages for Infusionsoft, you can simply search for “Infusionsoft” on BuiltWith to get a list of businesses using this tool:

You can create custom reports to drill down further based on the business’ location, domain, Alexa rank, website category, and other tech use.

This can be a fantastic source of highly detailed leads. You can zoom in and find businesses using very specific technologies, say - “businesses using Infusionsoft and SSL based out of Colorado”.

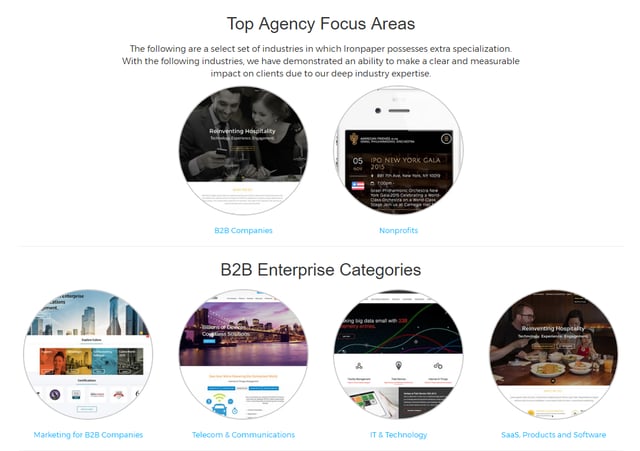

4. Set up Separate Landing Pages for Each Buyer's Personal

Business needs vary based on their niche, size, location, and growth stage. A SaaS startup looking to hire its first designer has very different requirements than a 100-person company looking to scale growth.

Yet, so many agencies use the same landing pages for all these businesses. The result: poor conversion rates.

Work around this problem by:

- Segmenting your target market into different personas

- Setting up landing pages targeting each of these personas

This gives you an opportunity to fine-tune your value proposition for each segment.

For example, Iron Paper, a growth marketing agency, has separate landing pages for all the industries it serves:

Each landing page identifies solutions and strategies specific to the industry. The landing page for telecom companies emphasizes marketing automation, while that for the IT industry focuses on content marketing.

Besides improving conversion rates, using separate landing pages also helps your SEO since you can use industry-focused keywords.

5. Send Cold Email Based on “Buying Signals”

Sending cold emails is a part and parcel of agency marketing.

However, instead of sending cold emails based on the business’ size or segment, send them based on “buying signals”.

In the context of cold email, “buying signals” are indicators that the business is in a growth stage or is actively looking for additional help.

Some buying signals are:

- The business advertising new positions on the job board

- A new round of funding

- An acceleration in marketing activity

- New product launches

New funding rounds and job ads are very strong buying indicators. If the business is actively looking for extra help, they are in “buying” mode and hence, have the budget and the need for outside expertise and ideas.

6. Host or Participate in Virtual Summits

.jpg)

Virtual summits are web-only versions of real-world conferences. They follow the same format - a group of experts share their insights with thousands of attendees. The only difference is that the entire “event” happens only online.

This format serves as a solid alternative to real-world conferences. Not only is it significantly cheaper to attend them (there are no travel or hotel costs, of course), but they also don’t require much of your time.

Plus, by participating in one, you get to appear alongside other niche experts. For agencies, this can be a powerful source of influence and authority.

Beyond the branding benefits, virtual summits can also help you capture leads and traffic.

In one case, an entrepreneur grew her list by nearly 3,000 subscribers from a single virtual summit. In another case, a virtual summit turned into six figures of revenue.

If you’re looking to host a virtual summit, here’s a list of tools you can use. This podcast interview with Navid Moazzez is a good starting point for understanding and hosting virtual summits.

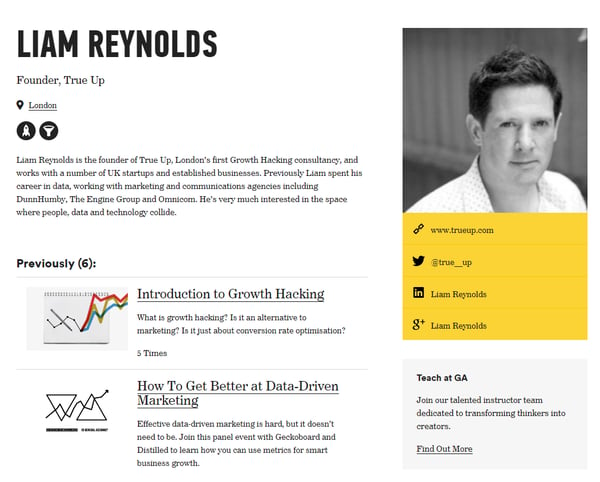

7. Offer a Course in an Online Bootcamp

There has been a steep rise in the number of boot camps - online and offline - in the last few years. While a large number of them focus on coding and development, a growing number also offer classes on marketing, UI/UX design and graphic design.

Offering a course on one of these boot camps is a powerful way to:

- Brand yourself as a niche expert

- Introduce yourself to a new audience

- Get exposure before companies looking to hire bootcamp graduates

For example, Liam Reynolds of True Up, a growth marketing agency, offers courses on growth hacking at General Assembly.

This marketing hack works best when you target bootcamps that offer “job ready” courses. Such bootcamps frequently have tie-ups with businesses looking for fresh hires. When you position yourself as an expert faculty, you get an easy “in” at these hiring businesses.

Here are some online bootcamps/schools where you can offer your courses:

- Shillington Academy (Design)

- Startup Institute (Coding, Web Design, Marketing)

- General Assembly (Design, Coding, Marketing)

- Bloc.io (Web Development, Design)

- Iversity (Sales, Marketing, Business)

- Designation (UI/UX)

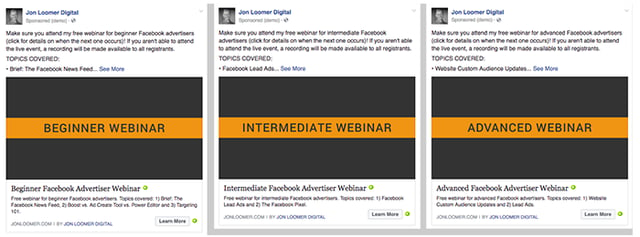

8. Run Facebook Ads for Your Webinars

Webinars rank among the best tactics for attracting an audience and turning them into buyers. According to a survey by Transcend, 63% of marketers ranked it as one of the best source of leads:

Getting people to attend your webinar, however, can be painful.

Solve this problem by running ads on Facebook for each webinar.

For example, Jon Loomer runs these ads to promote his webinars:

If you’re going to use this hack, make sure that you:

- Don’t mention dates on the ad. Reserve that for the landing page.

- Target people who’ve visited your site in the past.

- Use carousel ads to show multiple CTAs in the same ad.

- Use lookalike audiences based on your existing Facebook audience.

9. Use HARO to Get Press and Backlinks

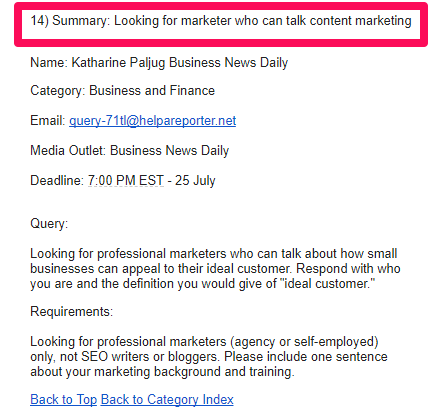

HARO (Help a Reporter Out) is a platform connecting journalists with sources. Each day, journalists looking for sources post their requirements on the platform. Sources can respond to queries, sharing their expertise and experiences in exchange for a press mention and/or a link.

Two of the most popular categories on HARO are “High Tech” and “Business & Finance”. HARO sends out two emails every day containing a list of queries for both these categories. For agencies in these sectors, HARO can be a fantastic source of traffic and links.

For example, here’s a call for content marketers sent out recently via HARO. The call specifically asks for agencies:

It might not be a fast way to get press, but it is highly repeatable.

That takes care of marketing and lead-gen tactics.

But what if you already have content and want to promote?

In that case, you'll love the next section.

1. Do “Guest Podcasting”

Guest posting is a time-tested tactic for improving authority, influence and your site’s backlink profile.

However, each guest post can take several hours to write, edit and publish. Guest posting is also an overplayed tactic on several leading blogs. This often causes great guest posts to get lost in the digital noise.

Instead of guest blogging, try a “guest podcasting” campaign instead.

The process is largely the same: find relevant podcasts, then pitch ideas for a guest spot. Up and coming podcasters are especially happy to feature niche experts who have something interesting to share.

This tactic works far better than guest blogging because:

- Podcasts have a “captive audience” and thus, a high engagement rate.

- A podcast interview takes only about an hour of your time, as opposed to 5-10 hours for a single guest post.

- Podcasts have a wider distribution channel (Stitcher, iTunes, etc.)

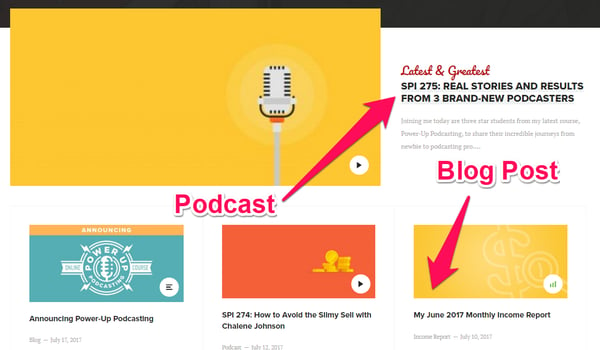

Most podcasters also promote their podcasts much more heavily than their blog content. For example, Pat Flynn of SmartPassiveIncome features his latest podcasts more prominently than his latest blog posts.

Read these articles on Sumo.com and PodcastMotor for help in pitching podcasts. Use Apple iTunes and Cast.Market to find podcasts to guest on.

2. Distribute Your Content to Curated Newsletters

Most niches typically a large number of newsletters that curate the best new content in the niche. These are either run by individuals or businesses. It’s not unusual for a newsletter to have several thousand subscribers, yet be hardly visible in search or social.

Distributing your content to such newsletters can be a fantastic source of targeted traffic for two reasons:

- As compared to reading a blog post, there is significant friction in signing up for a newsletter. Ergo, a newsletter’s subscribers are likely going to be more motivated and targeted.

- Newsletters aren’t competing for mindshare on the blogosphere. Instead, they give you direct access to your audience’s most valuable digital space: their inboxes.

To find such newsletters, use these search strings:

“[niche]” + newsletter

“[niche]” + digest

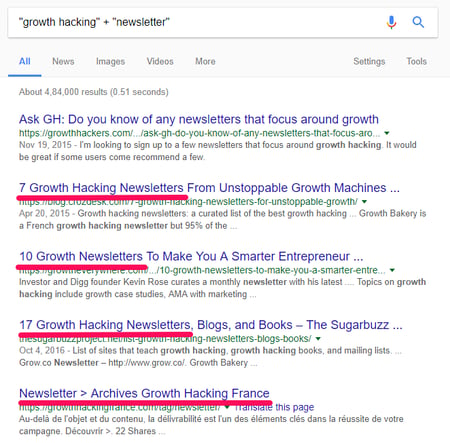

For example, searching for ‘“growth hacking” + newsletter’ shows me this:

You can easily find a number of newsletters in any niche.

Approach these newsletters just as you would approach a blogger. Subscribe to their newsletter, check out their content for fit, then ask them to include your content in their next issue.

3. Reach Out to Inactive Bloggers and Acquire Their Email List

Every niche has a large number of blogs that haven’t been updated in months or even years. Plenty of them also have associated newsletters or email lists that have been similarly ignored.

If you can acquire these email lists, you have a ready made audience for your content (as long as you reactivate the list correctly).

Finding inactive blogs is the hardest part of the process. You will have to rely on a lot of manual research to these expired sites.

Try searching for your target keyword. Skip the first few results pages and head to page 10+. Look for sites that:

- Haven’t been updated in a few months

- Don’t have any activity on associated social media profiles

- Have a newsletter sign-up form on their site

Next, find their contact information (use AnyMailFinder or look-up Whois data). Ask how many subscribers they have and whether they are willing to sell the list.

If you do manage to acquire an email list, send an email to your newly acquired subscribers about the sale. Also, identify yourself, tell them what kind of content you’ll share with them, and offer a prominent unsubscribe link.

This is a little-known marketing hack but it can yield some powerful results.

4. “Seed” Your 10x Content by Involving Influencers

The idea of “10x content” - content that is 10 times better than the competition - is now firmly entrenched in many agencies’ content marketing playbooks. When coupled with strong outreach, it can yield spectacular results as well. One way to get even more out of your 10x content is to “seed” it by soliciting feedback and quotes from influencers before you publish the content.

The idea behind this hack is to get influencers and power sharers invested in your content before it goes live. Then once you finally hit ‘publish’, you can hit these people up for shares. Since they’ve already “contributed” to the content, they will be more likely to share it.

There are several ways you can seed your content, such as:

- Share content outlines, mockups and wireframes (for mini-sites) weeks before you publish

- Get quotes from niche experts

- Find people who have shared similar content, then email them that you’re creating something similar. Ask if they’ll take a look at it (and share if it is good enough).

- Email any blog, website, or tool owner you’ve mentioned in your content. Tell them that you’ve mentioned them in the article and will share it with them once it’s live.

- Ask people who’ve publicly taken an opposing stand from your stated argument for quotes. Use this quote to create more controversy and present a different viewpoint.

The more influencers you can get to “buy in” to your content before it’s published, the better results you’ll get upon launch.

The success of your agency depends on the kind of people you can attract. In the next section, we'll share some onboarding/hiring tactics.

1. Record Repeatable Processes with Video

Your agency likely has a few repeating tasks it performs on a daily, weekly or monthly basis. These are usually tasks that don’t require creative input - republishing old tweets, following X number of people on Twitter, etc.

Instead of wasting precious man hours on such tasks, follow this approach:

- Document each repeatable task you or your team members perform in a day

- Record yourself doing the task via

- Outsource the task to low-level workers on

Even if you decide not to outsource the tasks, you can still use the recordings in your onboarding process for new hires.

2. Cut Down on Expenses with Remote Hires

This is less of a “hack” and more of a business strategy. However, given that office rent, electricity, etc. make up a significant chunk of agency expenses, this strategy can give you a serious leg-up on the competition.

We’ve covered remote hiring in an earlier post. The idea is simple:

- Map out processes and job requirements

- Post job ads on remote job boards

- Use chat tools like Slack, HipChat, etc. to make collaborate with remote workers

- Document all your processes (make videos for repeatable processes) and use them in onboarding

Conclusion and Key Takeaways

There is no single marketing “hack” that can explode your agency's growth. Instead, you’ll have to try and test a number of ideas and tactics until you find something scalable.

The more important part is how you approach your agency’s marketing. Instead of using tired tactics (“more blogging”, “social media promotion”), adopt a more experimental approach. Create more compelling content, then distribute it through unconventional means.

Use the hacks we’ve shared above as inspiration. You don’t have to use them as-is. Rather, fine-tune and adapt them based on your business needs.

Here’s what you should take away from this post:

- Investing upfront in content promotion yields strong results once you hit ‘publish’

- Virtual summits, online courses, and guest podcasting help establish you as an expert.

- Cold email businesses that are in “buying” mode.

- Use BuiltWith as a source of leads.

- Buy email newsletters from dormant blogs. Also, distribute your content to curated content newsletters.

Related Posts