Dealing with the COVID-19 crisis requires tough measures, as our latest article shows.

In the year 1697, the Dutch ship Geelvink commanded by Willem de Vlamingh landed on the western coast of Australia. While sailing up the Swan River, de Vlamingh and his sailors saw something extraordinary: black swans, native to Western Australia.

Until then, it was assumed that all swans were white. There was no real basis for this belief except that no one, before de Vlamingh’s voyage, had ever seen a black swan.

This story is the source of the Black Swan Theory. It describes an event so extraordinary and unexpected that it upends all established knowledge. The invention of the internet was a black swan event, as was the 2008 market crash.

While we’re still early days into the crisis, it wouldn’t be wrong to say that COVID-19 is a black swan event. You couldn’t have predicted it, nor could you have anticipated its impact.

Conventional rules go out the window during such a crisis. There is no standard risk management playbook for dealing with a worldwide epidemic; you have to improvise and adapt on the fly.

In this post, I’ll discuss this extraordinary event, how to deal with it, and how to minimize its impact on your organization.

1. Assess the Impact

While COVID-19 will affect demand and impact businesses everywhere, the distribution won’t be uniform. Businesses that depend heavily on movement, like travel, will be the first to be affected. Some others, such as retail, might see a demand crunch but still be relatively insulated.

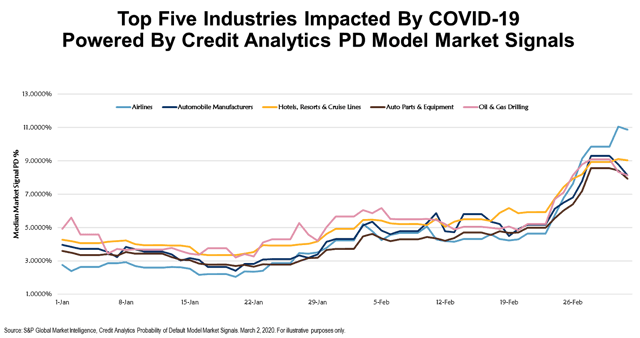

According to S&P Global, the biggest industries affected by COVID-19 will be airlines, automobiles, travel, and oil & gas:

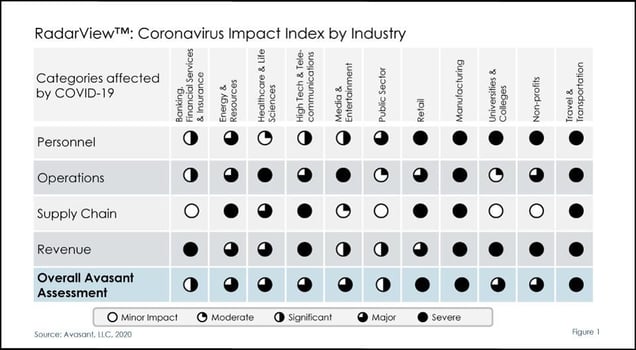

Not every part of an industry will be affected equally. Some industries, such as banking, might see a big drop in revenue, but won’t see the same impact on personnel as, say, manufacturing - as this Avasant study found out.

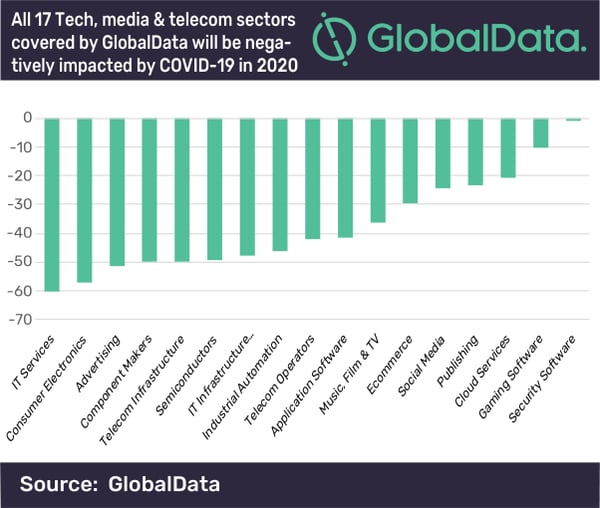

Some sectors might see a negligible impact or even experience positive growth (such as digital entertainment). Within the tech sector, for instance, demand for IT services will take a big beating. But security software will see a minimal drop in demand as companies focus even more on securing their assets in tumultuous times.

Your first step, thus, should be to assess the following:

- Direct exposure to heavily-impacted industries. If you have a client list filled with travel companies, now would be the time to cut costs heavily.

- Indirect exposure through your clients’ clients. For instance, if your clients sell heavily to travel or manufacturing companies, you will experience a demand crunch as well. Look at geographical reach as well - if you or your clients sell to countries heavily affected by COVID-19, you will be affected as well.

- Market impact based on the COVID-19 situation in your region. This can be hard to predict, however, given how rapidly the situation is changing.

2. Analyze Your Preparedness

Have 12 months of cash reserves and a client list filled with unaffected digital entertainment companies?

Then you might just sail through this crisis.

But not every business is as lucky. Your cash reserves, clients, margins, and processes will determine whether you survive or not.

Step two, thus, is to analyze your preparedness by evaluating the following:

A. Cash flow

How many months of cash do you have in the bank? What about invoices pending payment? Are pending payments largely from clients in heavily affected sectors?

B. Key financial metrics

Now is a good time to assess the key financial metrics related to your agency, including:

- Agency Gross Income (AGI)

- Client Concentration

- Agency Gross Income to Full-Time Employee (FTE) ratio

These metrics determine your margins and your exposure to risk. For instance, if you have a high client concentration, it means that you depend heavily on a handful of clients. Similarly, a low AGI: FTE ratio means that your margins are too low for your employee count.

Refer to this article to better understand these key agency financial metrics.

C. Expenses

As an agency, your two biggest expenses will be salaries and office rent. While you can’t readily cut salaries at a time like this, overexposure to fixed costs such as office rent can leave you unprepared.

Analyze your fixed vs variable expenses. You should be able to cut down on most variable expenses (such as sales commissions) easily. But if you have high fixed costs (such as rent) you might have to renegotiate your contracts.

D. Practices

If you’ve already embraced remote work, working through this crisis should be easy enough. Not only can you cut down on fixed office costs, but can also shift to 100% remote work without a pause.

Assess your practices with regard to the following:

- Remote work

- Collaboration tools

- Remote-friendly communication tools

- BYOD (Bring Your Own Device) policies

The more heavily you’ve adopted the above practices, the easier it will be to transition to working from home.

3. Evaluate Each Project

Let’s face it: some of your projects will be canceled. Some others would need a scope realignment. These are extraordinary times; assuming that things would go on as before is foolhardy.

I suggest getting a headstart and evaluating each of your ongoing projects. There is little chance that you would have something like COVID-19 in their risk registers. However, you should have some framework for dealing with extraordinary circumstances, so you should start with that.

Specifically, evaluate each project on the following counts:

- Risk exposure of the project owner to COVID-19 and its fallout

- Percentage completed in terms of deliverables, deadlines met, and budget used

- Risk exposure of key vendors. This is crucial in case the project depends on parts or talent from heavily affected countries

- Financial risk, such as delayed payments or a project that’s already over budget

- Personnel risk - does the project use too many resources that have never worked from home and thus, can’t transition to a remote environment easily?

Based on this analysis, you can suggest changes to clients. It’s better to retain a client with a significantly scope-reduced project than to lose them altogether.

4. Establish Communication Protocols

Right about now, you would have a stream of anxious emails from clients sitting in your inbox.

How do you respond to them? What can you say that will reassure them in these trying times?

Establishing communication protocols early on in a crisis can help you establish a sense of normalcy. It can also give comfort and stability to obviously worried clients.

What should these protocols include?

As a start, focus on the following:

- Whether you will continue to be operational throughout the crisis, and if yes, what percentage of your business will remain online? This is particularly important in case there is a lockdown in your local area.

- How will you share updates with the client? What will be the tools used for communication, proofing, approvals, etc.?

- What parts of the project should the client be concerned about?

- What should clients tell you about the status of their business?

Some clients will panic and seek to close half-finished projects. But it’s important to remind them that the crisis will eventually be over and sustaining a half-finished project with minimal resources would be better in the long run.

5. Go All-In on Collaboration and Remote Work

With constant - and uncertain - lockdowns everywhere, you can’t really rely on working from an office anymore. In fact, it wouldn’t be wrong to say that the age of “normal” office work is over. Going forward, expect more and more agencies to switch to mostly remote work.

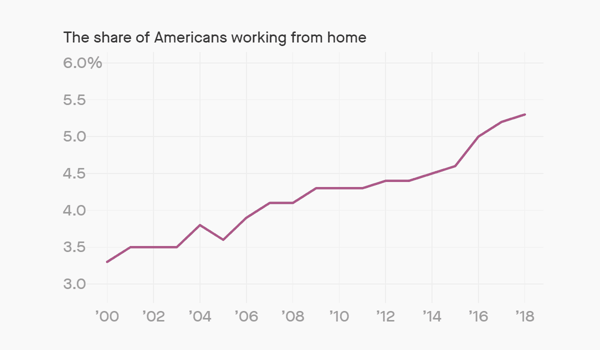

The percentage of people working from home is expected to rise sharply due to the COVID-19 crisis (Image source)

If you haven’t embraced it already, now is the ideal time to go remote (not that you have much of a choice!). Also, go all-in on collaboration and seamless communication - the bedrock of successful remote work.

We’ve written about remote work earlier. For the most part, you need the following to be successful:

- The right remote working tools, especially for seamless communication and video

- A unified project management tool that gives a complete picture of the entire agency’s operations, such as Workamajig

- A focus on processes and decentralization so that people can get work done without micromanagement

- A culture that promotes transparency, sharing, collaboration, and teamwork over individual brilliance

This isn’t an overnight process, but if you want to thrive through this crisis - and future ones to come - it is essential to invest in these assets.

6. Reassure Your People

Lastly, the single most important for any agency is its people.

Right now, your people are scared. They are anxious about their jobs, their health, and their careers.

Protecting them should be your number one priority. Start by taking measures such as:

- Adopting work from home policies

- Cutting out all non-essential travel

- Cutting non-essential expenses

- Cutting executive salaries, if possible

The agency that can retain its talent through this period will be in a much, much better position to win clients once the crisis is over.

Keep that in mind before you decide to cut any staff.

Over to You

COVID-19 is an extraordinary crisis that will test your leadership and management skills. You will have to make tough decisions. You will also have to change the way you work.

While no one can truly predict how this crisis will play out, assessing your preparedness, being transparent with your people and clients, and adopting better work practices will help you survive the downturn.