There are a few reasons why businesses find QuickBooks inadequate for their needs: some report inflexible customization options, others note insufficient reporting, and many say QuickBooks offers limited integrations with other software in their tech stack. They’re stuck patching together QuickBooks data in spreadsheets and, ultimately, feel that it isn’t conducive to overall business growth.

However, when it comes to comparing alternatives, it can become tricky due to the numerous options available.

In our experience, we’ve found that these alternatives typically fall under three categories:

-

Direct alternatives, such as Xero, Zoho Books, Sage Intacct, and FreshBooks. Businesses may consider these if they need accounting software with similar capabilities to QuickBooks. These tools share the same core features but differ in their interfaces, pricing, niche features, integrations, customer support, and reporting capabilities.

-

Enterprise accounting software, including Oracle NetSuite, Microsoft Dynamics, and Acumatica. Enterprise solutions support businesses with a greater frequency of transactions and more complex accounting needs.

-

All-in-one systems that combine accounting with project, resource, and client management. Workamajig, Clients & Profits, and Advantage fall under this category. These systems are ideal for agencies for the reasons we highlight below.

Although businesses across industries use standalone accounting tools like Intuit QuickBooks, they’re not the best choice for agencies because they separate financial data from project activities and resource management.

Consequently, agencies face challenges with:

- Budget overruns. Project teams can’t compare project estimates vs. actuals or track budget overruns until they calculate labor hours and aggregate bank statements, receipts, and invoices from accounting teams.

- Accurate project and resource planning. When project managers don’t have financial data at their fingertips, they struggle to plan projects accurately, allocate resources, and estimate costs. They’re forced to navigate different systems or make guesstimates, an exercise that’s both time-consuming and error-prone.

- Accurate invoicing. With standalone tools, project managers must build invoices from scratch and manually collect data on projects, deliverables, labor hours, and other resources.

- Determining profitability at the project and account levels. You can track income, cash flow, and measure your agency’s overall profitability with standalone tools. However, it’s more challenging to determine which projects, clients, and services are profitable. For example, you may want to know if any of your popular services are generating a loss. Or if billing out expensive resources to specific projects is shrinking your profit margins.

All-in-one agency management systems like Workamajig integrate accounting with project and resource management, allowing agencies to manage finances within their workflows. They can monitor actuals vs. estimates, capture project costs in real time, automatically generate accurate invoices, and measure profitability at both the account and project level.

In this guide, we'll focus primarily on QuickBooks alternatives for agencies, explaining how these tools are tailored to agency projects and workflows. After, we'll briefly review other QuickBooks alternatives if you feel agency-specific tools aren't your best fit:

-

The best agency management systems with accounting modules, including: Workamajig, Advantage, Clients & Profits

-

Standalone accounting software for small and medium-sized businesses, including: FreshBooks, Sage Intacct, Xero, Zoho Books

-

Standalone enterprise accounting solutions, including: Acumatica, Microsoft Dynamics, NetSuite

To learn more about Workamajig, keep reading or request a free demo with our team.

3 QuickBooks Alternatives for Agencies & Creatives

1. Workamajig

Workamajig is an all-in-one agency management system that supports core agency workflows and operations — including project, resource, financial, and client management. Our complete GL-ready accounting module replaces systems like QuickBooks, supporting all accounting processes and best practices, multiple currencies, and global compliance requirements, including GAAP, GDPR, and HMRC.

Unlike standalone tools such as QuickBooks or Xero, Workamajig combines project, resource (including labor hours), and accounting data in a single platform, helping agencies:

-

Build profitable project plans. While project managers build project plans, Workamajig utilizes historical and current data to estimate costs, enabling PMs to budget accurately.

-

Monitor project costs in real-time. After projects begin, Workamajig tracks labor hours and rates in addition to other project expenses (such as vendor costs) and proactively alerts you if there’s a risk of budget overruns.

-

Save time and generate accurate invoices. Moving siloed data across different systems — e.g., from your project management and time tracking tools to your accounting software — is a tedious process that creates errors and redundancies. Workamajig automatically aggregates and feeds relevant data to invoices, eliminating inaccuracies.

-

Capture granular profit and loss (P&L) insights. You can go beyond company-level P&L insights and generate tailored P&L reports for your clients, campaigns, and projects. These insights can help you make data-driven decisions to improve future profitability (e.g., by updating pricing or optimizing resource allocation).

Although Workamajig can be used as a standalone accounting system, you'll get the most value by combining our full suite of native tools — including project and resource management, time tracking, CRM, and team collaboration.

Using them together simplifies workflows, centralizes project analytics, saves time, and significantly reduces costs. Agencies leverage Workamajig to:

-

Strategically manage projects and tasks. Workamajig’s project management suite includes all the core capabilities you’d find in dedicated PM software, including project planning tools, Kanban boards and Gantt charts, team collaboration tools, project monitoring with timeline and budget tracking, and customizable project intake forms.

-

Track time, optimize resource allocation, and measure productivity. You can track each team member’s workload and current schedule, assign tasks, and measure billable vs. non-billable hours to allocate resources optimally. Workamajig’s utilization reports also help you determine which clients and services require the most resources.

-

Manage relationships with freelancers and other vendors in one place. You can request quotes, compare bids, assign tasks, and keep communication flowing through (unlimited) custom vendor portals. Thanks to Workamajig’s accounting module, you can also receive and reconcile vendor invoices without breaking stride.

-

Manage pipeline and client relationships. Our native CRM enables you to manage new leads, track opportunities through to close, and analyze won vs. lost opportunities with detailed reports. You can also create dedicated portals for clients to request work, share feedback, check project progress, and retrieve deliverables.

Up next, we'll cover Workamajig’s accounting management features and show how it combines project and financial data. You can also request a free demo for a live product walkthrough.

Workamajig’s Today Dashboard & Chart of Accounts

Workamajig’s Today - Accounting dashboard distills information from our accounting and project management modules into simple updates and actionable insights, displayed in a single, intuitive dashboard. The dashboard includes account balances, items needing attention, a daily feed of current to-dos and updates, and conversations for accounting teams to easily see what to be working on.

Workamajig’s Automated Estimating & Real-Time Budget Monitoring

As we explained above, our system calculates estimates and budgets (for the entire project and specific phases) as you build plans and allocate resources.

Then, after kickoff, it monitors project expenses against budgets to see if you’re on track — and notifies managers if any projects become at risk of budget overruns. These real-time alerts empower managers to correct risks before projects exceed their budgets.

For example, let’s say your team spent $1500 over the estimated budget on an ad slot, or a specific task took five hours longer to complete than expected. The project manager can step in to send clients change orders for budget increases or cover the costs by redistributing budgets away from other deliverables.

You can view project and campaign budgets by item, type, task, and person using Workamajig’s budget drill-downs:

Workamajig’s project budget tracker doesn’t just monitor overruns — it also offers a profitability breakdown to help you view the expected ROI for a project over time. The tracker provides an initial profitability projection when calculating project estimates, and updates the expected profitability as the project progresses.

Read more: 8 Tips for Managing a Project Budget (+ Budgeting Methods)

Workamajig’s Credit Card Connectors

You can import charges from both credit card and spending accounts by linking them to Workamajig via our Plaid integration. You’ll also have the option to:

-

Auto-sync charges so they update nightly, allowing users to review and categorize expenses.

-

Tag project-related charges so they can be incorporated into project budgets and invoices.

Workamajig Receipt Management

Our receipt management module lets team members upload and share receipts with the finance team, rather than carrying physical copies and submitting them at the end of the month.

Digitizing receipts eliminates manual filekeeping and saves project teams time when generating invoices.

Workamajig Vendor Invoice Management

Workamajig’s accounting system saves agencies hours on invoice processing times by centralizing vendor invoices and automating approval workflows. Managers and accounts payable teams can add and attach copies of vendor invoices to our system, reconciling them with purchase orders, work orders, and receipts before sending them forward for payment processing.

You can send online payments directly from Workamajig thanks to our integrations with Edenred Pay (formerly CSI) and AvidXchange (formerly FastPay).

Workamajig Expense Management (and Reimbursements)

Workamajig helps agency staff simplify expense management with tools to:

- Create and send expense reports (including via mobile device).

- Tag out-of-pocket charges to request reimbursements. Managers can view and approve these requests.

Workamajig Automatic Invoicing & Billing

Workamajig automates invoicing and billing, and simplifies related editing and approval processes.

Our platform supports several client billing methods, including:

-

Time & Materials: Allows you to bill clients based on a project’s actual labor hours (at their assigned rates) and expenses incurred. Your profits are worked into the hourly rates.

-

Retainer: A simple recurring billing method for charging the client a fixed amount over a specified period, at an agreed-upon frequency. For example, $10,000 a quarter for one year.

-

Fixed Fee: Also known as “project-based” or “fixed-cost” billing, it’s used to bill clients a flat fee for each project. Agencies use Fixed Fee billing for projects with accurate cost estimates, allowing them to negotiate a profitable agreement.

-

Advanced Billing: Used to collect payments upfront without reporting the income, and realize revenue as the project progresses. Agencies use Advanced Billing for different reasons, such as collecting a deposit for a project (e.g., 25% upfront) or for hours-based retainer agreements.

-

Prebilling: Invoice clients for expense items before your agency receives a vendor invoice. Agencies commonly use prebilling for media insertion orders to prevent cash flow strain.

-

Work-in-progress (WIP) Billing: For recognizing unbilled expenses or labor costs that have been incurred but not yet invoiced to the client. WIP billing aligns revenue and costs to the same period if you aren’t billing project costs at the end of each month. Otherwise, direct costs may be posted to your P&L statement in one period, and revenue may show up in another, distorting profitability.

Here’s how Workamajig automatically generates new invoices for completed projects:

-

It pulls all line items and costs (including labor hours) from the project, and generates a billing worksheet based on your chosen project billing method.

-

Workamajig automatically routes the billing worksheet to managers for approval. Managers can make any necessary final changes, such as editing line items, adding project-related charges, or adjusting costs.

-

The billing team can then generate an invoice from the approved billing worksheet.

Workamajig also simplifies the payment process for clients. Thanks to our integrations with PayFlowPro and Authorize.net, your clients can pay directly via CC or ACH, directly from the invoice, in just a few clicks.

Media Buying Integrations

Workamajig excels at tracking budgets and preventing overruns by aggregating all your different costs and comparing them against budgets. To this end, our platform also enables you to track expenses from media buys through our integrations with Strata/FreeWheel, Mediaocean, Bionic, and GaleForceMedia.

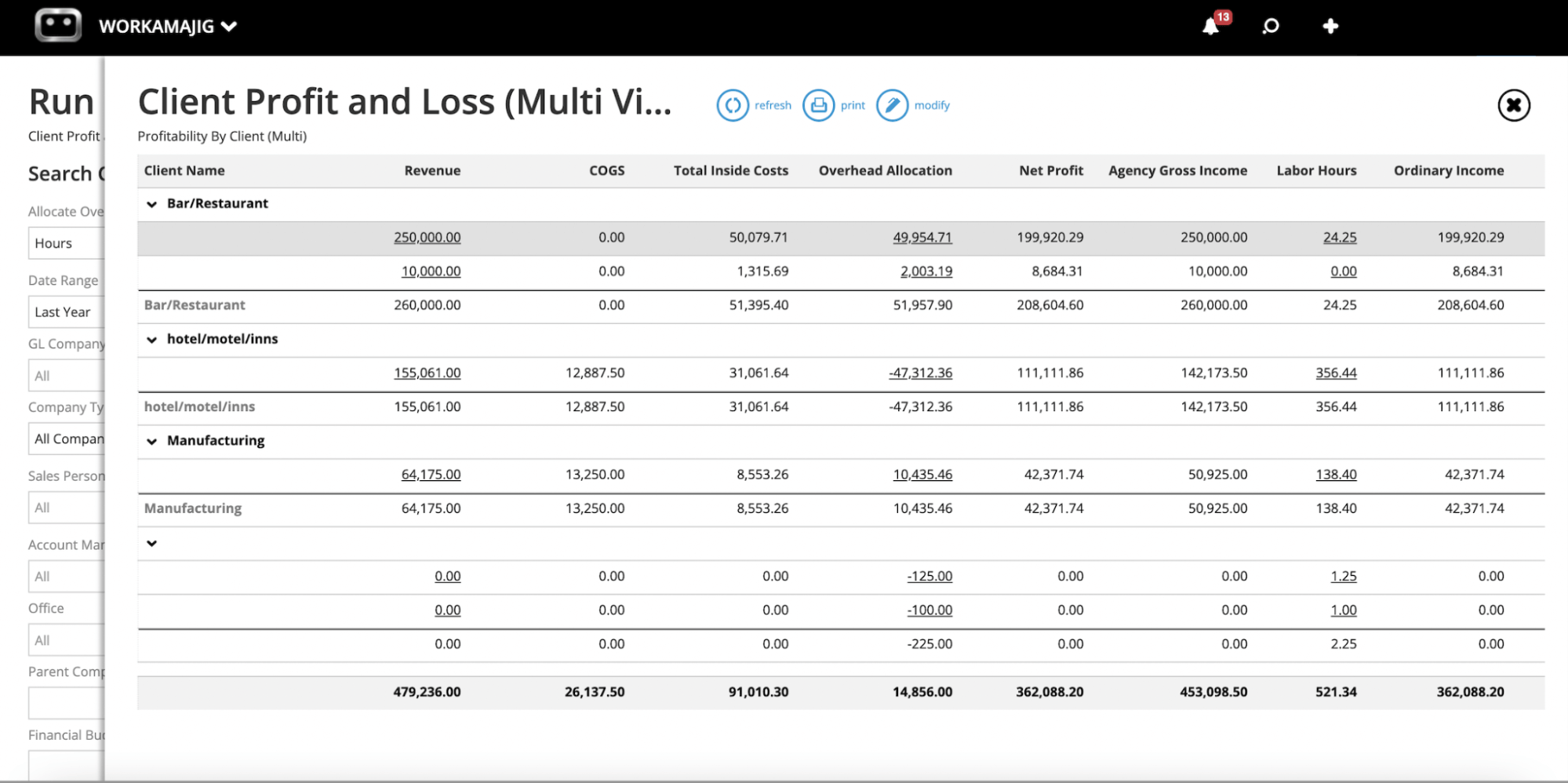

Financial Reporting

Workamajig’s financial reporting dashboard provides granular insights into cash flow, profitability, and productivity, offering both pre-made reports and customizable reporting tools. Agencies use the following reports the most:

- Cash projections

- General ledger (GL) reports to measure cash flow

- Profit & loss reports. You can generate company-level P&L reports or filter them by campaign, client, project, etc.

- Project budget analysis

- Revenue forecasting

Workamajig also features a Key Metrics Monitor that lets you automatically track how your financial metrics trend over time.

Workamajig’s Full Suite of Agency Management Tools

Workamajig’s agency accounting software is designed to replace standalone systems fully, such as QuickBooks. But you don't have to stop at accounting — our full suite of tools can drastically simplify your core tech stack.

Workamajig's all-in-one agency management system replaces the following tools:

1. Project Management Software.gif?width=906&height=451&name=GIF%203%20(7).gif)

You can manage the entire lifecycle from project intake to invoicing using Workamajig’s native project management suite, which includes:

-

Customizable templates for project planning and budgeting.

-

A role-based Today dashboard that displays each user’s tasks, timelines, conversations, alerts, and more, in one place.

-

Real-time project monitoring with Gantt charts that display each project’s progress. The project monitoring dashboard includes health meters, color-coded status icons, and real-time risk alerts that proactively notify managers about potential time or budget overruns.

-

Collaboration tools (more on these below) and scope creep management to facilitate creative work and feedback processes, and keep projects on plan.

2. Staff Scheduling and Time Tracking

.gif?width=906&height=510&name=gif%202%20(7).gif)

With Workamajig, project managers can:

-

Instantly view each team member’s tasks, meetings, workload, and allocated hours from a centralized dashboard.

-

Manage priorities, assign and reassign tasks based on bandwidth and/or priority, and ensure all project activities are assigned to the most appropriate team members..

-

Choose the right fit for each task using our “find and filter” tool, which filters by department, office, role, service, etc.

Our native time tracking tool comes into play here, allowing team members to record hours directly in the system and tie them back to specific project activities. Our system automatically updates labor hours, budgets, and projects as users submit time.

3. Creative Collaboration Tools

Our system enables teams to communicate effectively with all stakeholders (internal and external), quickly share documentation, and facilitate seamless feedback. Workamajig’s collaboration tools include:

-

Native file sharing: Teams can upload, organize, and share files across projects. They can even create folders to neatly organize files within projects.

-

Smart tagging and change tracking: Project managers can tag clients to review specific deliverables and monitor edits across revisions.

-

Threaded commenting for contextual feedback: Managers and creatives can comment back and forth on feedback and revisions, allowing for a more nuanced and effective exchange of ideas. Our system saves all comments, allowing PMs to view the entire progression of work, understand how decisions were made, and see how final deliverables were developed.

-

Version control & history, including the option to compare versions side by side.

-

Custom portals to correspond with outside users, including vendors, clients, and teams from other departments. For example, managers can enable clients to view project status, submit feedback, and request new work — all through a secure portal.

4. Client relationship management (CRM)

With our native CRM, sales teams can view and qualify incoming leads, work new opportunities to close, manage the entire sales pipeline, and forecast revenue and resource requirements from earned opportunities.

.gif?width=906&height=510&name=gif%202%20(4).gif)

Workamajig’s CRM lets you:

-

View new leads and their information. (You can connect our CRM with your website’s contact form or import leads from another CRM like HubSpot.)

-

Track conversations with leads and send follow-ups.

-

Assign opportunities and specify details such as stage, type, and status.

-

Forecast revenue & resourcing needs and create estimates using templates.

-

Convert earned opportunities to new projects and automatically transfer details and attachments from sales conversations to the project management module, helping PMs hit the ground running.

See Workamajig in action in this 1-minute demo:

For a detailed and personalized demo, please contact our team.

Workamajig Case Studies: Improving Profitability with Centralized Accounting

Here’s more on how different agencies have simplified billing and streamlined their financial reporting with Workamajig:

-

“With the click of a button, I now know exactly how profitable a client or project is. We used to have all these different systems that forced us to spend tons of time — hundreds of hours — manually merging data and plugging it into spreadsheets to figure it out.

Workamajig is saving us tons of hours. Our twice-a-month billing cycle used to take multiple people a combined 20 hours of work. This last cycle, it took four hours… not because we don’t have as many clients, but because we’re getting more efficient.”

– Scott Millen, Managing Partner and Creative Principal at 2Fish Company, LLC, an award-winning creative marketing agency.

Read the complete case study to learn more about how 2Fish Company reduced its time spent on billing by 80%. -

“Our old system was basically just for accounting; it was not a project management system. We had a clerk who keypunched timesheets into our system for billing and accounts payable. And, at billing time, correcting hours or expenses from one job to another meant physical folders, handwritten notes, and more accounting time.

Workamajig was fast. We set the system up, added information on all of our accounts, decided whether to import/export our other systems like vendors and clients, and also determined how to set up our tasks and items — all the different pieces to it.

It’s made a huge difference in our efficiency, in broader access to information, and in account management staff’s understanding of that same information.”

– Lisa King, CFO/VP at Spawn Ideas, a leading creative advertising agency based in Alaska. Read the full case study here.

-

“I would say the biggest thing I found useful was being able to track our projects and how we are doing on labor, costs, and budget — something which we really didn’t have insight into before. The amount of data that is available in one place and available to multiple people in the company who need that information is the thing that I find most exciting about Workamajig.”

– Dawn Peters, Controller at Parallel Path, Colorado, a digital marketing agency that helps health, wellness, and lifestyle brands.

Watch this clip to hear more about Parallel Path’s experience with Workamajig.

Getting Started in Workamajig

We offer agency-specific packages with pricing based on team size and user seats. Check out our rates below:

Book your personalized demo to discover how Workamajig can meet your accounting needs.

Related reads:

- 5 Best Media Accounting Software

- Best Accounting Software for Advertising Agencies

- Agency Cost Management Tools & Best Practices

2. Advantage

.png?width=2000&height=878&name=Advantage%20Simpli.fi%20homepage%20(2024).png)

Advantage is an agency management system with an accounting module that fully replaces QuickBooks. The platform also supports project, resource, and financial management. And thanks to its integration with Simpl.fi, Advantage also offers built-in media planning and buying tools, making it a popular choice for advertising and media planning agencies.

Many users praise Advantage’s various accounting capabilities, including its:

-

Advanced billing and invoicing tools that help agencies save time.

-

Budget tracking that compares estimates vs. actuals at the project level.

-

Integrations with bank accounts, credit card accounts, and outside systems, which help consolidate project expenditures that were paid via credit card payments and bank transfers.

-

Financial reporting for measuring cash flow, profitability, revenue, and revenue projections.

-

Support for several billing methods, including the option to create automated billing rules to help generate estimates quickly.

The potential downsides of using Advantage are:

-

Limitations with multi-account and multi-currency accounting: Users note that Advantage’s accounting module falls short in this regard.

-

A steep learning curve and clunky interface: Users note long onboarding times and unintuitive functionality with Advantage. Although the vendor provides training to support onboarding, implementation times still typically run long.

-

Expensive pricing: While Advantage doesn’t share its pricing online, we’ve heard the vendor’s pricing is tailored to larger agencies and enterprises. Consequently, smaller agencies may be priced out of conversations at the demo stage.

Advantage Features Overview

- Media accounting software

- Integrations with bank and credit card accounts (to centralize project spending)

- Billing & invoicing

- Estimates

- Budget Monitoring

- Financial reporting

- Revenue forecasting

- Risk analysis & burn rate tracking

- Project management

- Resource management

- Collaborative tools like proofing & reviews

- Time tracking

- Media planning & buying — including broadcast buying, digital buying & media reporting

- Reporting dashboard (to analyze project performance, financials, staff hours, etc.)

- Mobile app (for Android)

Pricing

Advantage offers custom quotes per agency.

Read more: Best Advantage Software Alternatives for Creative Teams

3. Clients & Profits

Clients & Profits (C&P) is an on-premise agency management software for advertising teams, designers, and marketing teams. The platform features native project management, resource planning, time tracking, media planning tools, integrations with media buying platforms, accounting software, and financial reporting capabilities.

Agencies use C&P’s accounting tools for:

-

Monitoring project costs and comparing actuals to budgets by accessing financial data within project and campaign workflows.

-

Tracking billable work and expenses, helping users make data-driven decisions around project planning and resource allocation.

-

Automating repetitive, manual accounting tasks, such as creating invoices, managing recurring invoices, bank reconciliation, and accepting payments across different channels.

-

Vendor invoice management, including organizing, reconciling, and paying invoices.

-

Digitizing essential documents — such as client & vendor invoices, POs, and receipts — which simplifies filekeeping.

-

Financial reporting, with premade P&L reports and revenue forecasts.

C&P’s accounting module provides the same core capabilities as standalone systems such as QuickBooks. It’s also a better fit for creatives and agencies because it combines project and financial data, helping you:

- Make accurate estimates and project plans using historical data.

- Track project-related expenses as they’re incurred.

- Monitor project budgets in real-time.

- Generate accurate invoices by automatically pulling cost data from projects.

While C&P is a robust agency management system with advanced features for accounting and finance, it has two notable drawbacks:

-

Since the platform is deployed on-premise, your team is responsible for the setup (which can be lengthy and challenging) as well as software maintenance and updates. This on-premise deployment also means you cannot access C&P on the go, from internet browsers or mobile apps. You must be physically present at your desk, in front of the device it’s installed on, to use the system and catch up on projects.

-

Some users find its interface to be clunky and dated. You can take a visual tour of the platform to form your own opinion, or schedule an online demo to see all of C&P’s capabilities.

C&P Features Overview

- Accounting software

- Automatic billing & invoicing

- Vendor invoice management

- Financial reporting

- Integrations with bank and credit card accounts & media planning systems

- Project request forms & project planning

- Project management & monitoring — request forms & project planning tools, such as task management

- Resource management — team management with live scheduling & time tracking

- Collaborative feedback tools for project teams & clients

- Portfolio management

- Workflow automation

- Adobe XD plugin

Pricing

Clients & Profits has three main pricing categories — “Studio” for graphic designers, “Agency” for advertising agencies, and “Marcom” for marketers.

C&P charges per user, and the rates are role-dependent (for example, a PM’s seat costs more than a creative user):

Clients & Profits also offers discounted rates for freelancers ($9 per month) to access the creative platform and time-tracking tools.

Read more: Clients & Profits Software: Reviews & Alternatives

4 standalone accounting software alternatives to QuickBooks

Xero, Zoho Books, FreshBooks, and Sage all offer similar core capabilities to QuickBooks. Users may choose these providers over QuickBooks due to differences in plans, pricing, niche features, user-friendliness, customer support, and multi-currency & multi-entity accounting capabilities.

-

Xero — a QuickBooks alternative founded in 2006 in New Zealand. Positive reviews highlight Xero’s user-friendly interface, seamless bank integrations, and automation capabilities. Some users note that Xero’s multi-currency options are limited. Read more reviews here.

-

Zoho Books — a cloud-based small business accounting software with a free plan that offers basic features. Users praise its clean interface, affordable pricing, and seamless integrations with Zoho’s suite of business products and third-party providers (e.g., Gusto integrations allow you to run payroll). Some users highlight a steep learning curve for non-accounting users and disappointing experiences with the vendor’s customer support team. Read more reviews here.

-

FreshBooks — an all-in-one accounting software designed for small business owners, self-employed professionals, and accountants. Users praise its simplicity, multi-currency support, and the option to import transactions directly from bank accounts (simplifying expense tracking) for bookkeeping. Some users note the high cost of adding additional users to FreshBooks. Read more reviews here.

-

Sage Intacct — a UK-based cloud accounting and invoicing software for small businesses. Users praise its customizable automations — particularly those related to tasks, invoicing, and reconciliations — and its detailed reports. Users note that Sage reliably handles multi-entity accounting, a feature that small business accounting systems often struggle with. Some users have highlighted performance issues with the platform, particularly when importing a large number of transactions. Read more reviews here.

Read more: Xero Alternatives for Creative Agencies & Marketers

3 enterprise accounting software alternatives to QuickBooks

Enterprise accounting solutions are tailored to the needs of larger organizations, excelling in supporting multi-entity and multi-currency accounting. They also integrate with broader enterprise resource planning (ERP) modules, such as payroll software and inventory management systems. These platforms typically have high implementation and licensing costs, long implementation times, and steep learning curves.

-

Oracle NetSuite — an ERP solution provider with powerful accounting and financial tools. Users praise NetSuite’s multi-entity accounting features, seamless integrations with third-party tools (including ecommerce platforms), and powerful reporting features. NetSuite’s high pricing, costly add-ons, and training services price smaller businesses out. Read more reviews here.

-

Microsoft Dynamics 365 — Dynamics 365 is Microsoft’s full suite of business applications, including an ERP with powerful financial and accounting tools. It consolidates the general ledger, accounts payable and receivables, and fixed assets in a single platform. Users praise Dynamics’ seamless integrations with Excel and Outlook, as well as its robust reporting capabilities. Read more reviews here.

-

Acumatica — a cloud-based ERP system that lets businesses manage operations, finances, payroll, and inventory tracking in one place. Users praise Acumatica for its ease of use, real-time financial data that can be accessed via desktop and mobile, and multi-entity accounting features. Some users note high implementation and licensing costs, as well as a steep learning curve. Read more reviews here.

Read more: Best NetSuite Alternatives for Agencies & Creative Teams

What’s the best QuickBooks alternative for you?

While standalone accounting systems can work well for companies of all sizes across various industries, ranging from retail and construction to healthcare and telecommunications, they aren’t the best option for agencies and creative teams. They don’t provide actionable insights for tracking project outcomes and improving profitability. For example, they don’t help you:

- Measure which projects, clients, and services are profitable and which aren’t.

- Catch potential budget overruns and take corrective action.

- Make smart decisions about resource allocation to improve profitability.

Agency management systems — such as Workamajig, Clients & Profits, and Advantage — provide these insights and more by integrating accounting with project management in their native platforms. These systems were designed specifically for agency and creative operations, boasting all the necessary features and functionality to support their workflows and best practices.

We’ve proudly serviced agencies at all stages of growth — from small teams struggling to track profitability, to enterprises that require robust forecasting capabilities — for over 30 years.

Request a personalized demo to discover how Workamajig can support your agency.